There’s a lot of pressure when you undertake a new employee benefits RFP. Indeed, finding the right combination of employee benefits has a significant impact on employee morale, talent retention and recruitment.

Whether you’re a procurement manager or HR professional, searching for a benefits broker or a benefits administration software isn’t an everyday occurrence. Luckily, an employee benefits RFP offers an organized way to manage the process, enabling you to make a carefully considered, data-based decision.

In this blog, we’ll cover everything you need to know to effectively manage a benefits RFP. To begin, we’ll offer some foundational information like key definitions and RFP benefits. Then, we’ll offer five benefits RFP best practices. Finally, you’ll see several benefits RFP examples and a helpful template.

- Employee benefits RFP basics

- 5 best practices for issuing an employee benefits RFP

- Sample RFPs for employee benefits: Examples and templates

Benefits RFP basics

The importance of employee benefits

Having competitive employee benefits is crucial to your business. Not only do employee benefits impact your recruitment and retention efforts, but they can also impact your reputation. Now more than ever, employers need to deliver benefits plans that are comprehensive, affordable and creative.

As competition for the best candidates heats up, the days of simply offering vacation, health and retirement plans are gone. Indeed, the term ‘employee benefits’ now encompasses those traditional benefits as well as new offerings, sometimes referred to as fringe benefits. For example, it’s common to see recruiting employers offer flexible work, professional development, childcare and wellness benefits to tempt talent.

It’s easy to see why, as 79 percent of employees prefer better or additional benefits to a pay increase according to a study from Glassdoor. And, it’s no wonder when you consider that benefits make up about 30 percent of an employees’ total compensation.

What is a benefits RFP?

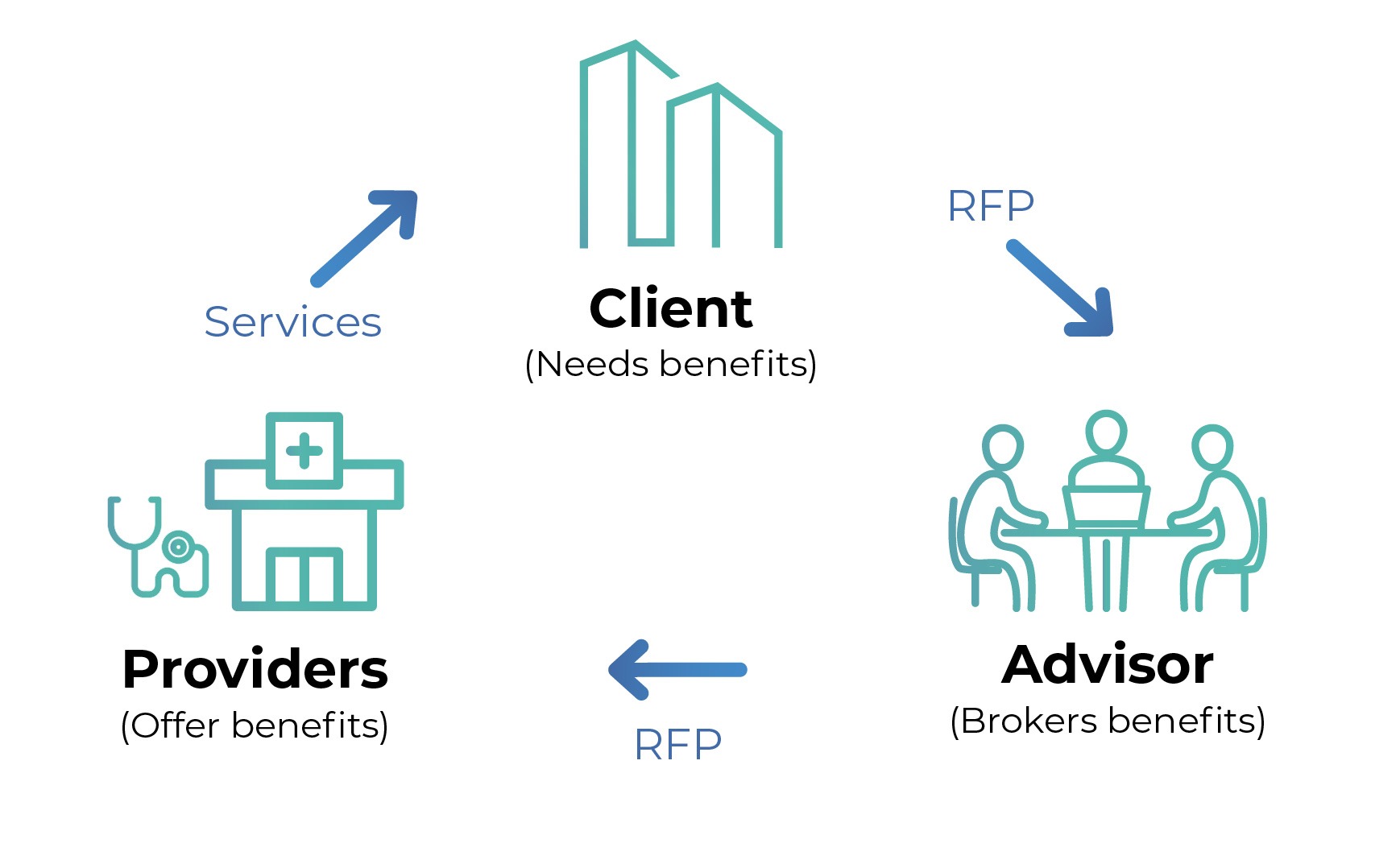

A benefits request for proposal is a questionnaire issued by an organization to gather information and compare potential employee benefits brokers, consultants and providers. The selected advisor then leverages their expertise and relationships to find the right providers for the business.

Overview of the benefits RFP process

- A business issues an RFP to find the best benefits broker or consultant

- They receive proposals, score the RFP and select an advisor

- The advisor then evaluates the business’s needs and issues an RFP to benefits providers

- Benefits providers respond and the advisor reviews and scores the proposals

- The advisor provides the client with recommendations and they make their selections

As you can see, within the benefits procurement process, there are two sets of RFPs. The first RFP is issued by the business to potential brokers. The second set of RFPs are issued by a broker to potential providers.

Who runs the process?

Employee benefits RFPs usually come from the human resources or procurement department, operating independently from one another. Unfortunately, this often leads to less than ideal outcomes. When HR runs the process, the business may miss the opportunity to leverage the negotiating power of procurement to save money. On the other hand, when procurement is in charge they may neglect to properly prioritize and weigh all the factors in favor of cost reduction.

Consequently, the best approach is a joint effort between the two departments. Human resources should inform the RFP process, engage in proposal scoring and broker selection. At the same time, procurement manages the creation of the RFP, vendor communication and negotiation. Likewise, the final selection of benefits from your broker’s recommendations should be a joint effort.

Not only should HR and procurement partner up, but involving other departments also improves results. Consider engaging with legal, information services, finance and any other who may have valuable input to the process early so their feedback can be incorporated into the initial RFP.

When should you consider a new broker or providers?

Finding a new broker or benefits provider isn’t an everyday task. As with most vendor relationships, ideally, you’ll find a long-term partner and avoid repeating the RFP process. However, from time to time you’ll need to explore your options.

It’s time to issue a benefits RFP if:

-

-

- Your current broker relationship isn’t meeting your needs

- It’s been three to five years since you last checked the market

- There’s been a significant change to your business or employee needs

-

Five best practices for a benefits RFP

The benefits RFP process takes time. Remember, first you’ll manage your own RFP process to find the right broker or consultancy for your business. Then, the advisor you select will issue RFPs to benefits providers to find the right ones. Accordingly, you may need to start your RFP process a year or more in advance of your current plan or broker contract expiration. It’s a long process because it’s so important to get it right.

One reason to start early is to give yourself time to conduct research. Needs and trends in benefits change incredibly rapidly. For example, a 2018 survey from America’s Health Insurance Plans (AHIP) reported that only 14 percent of employees considered mental health services a priority. In contrast, a 2021 survey of benefits trends from Willis Towers Watson reported that 73 percent of respondents plan to increase their mental wellbeing support. It’s a significant shift in approach in just four years. So if you’re asking the same questions from your last benefits RFP, you may miss the mark.

Key takeaway: Give yourself plenty of time to prepare. Leverage employee surveys and third-party research to explore the trends, creative new offerings and innovations in employee benefits.

For more about how to plan an employee benefits RFP, check out this infographic: 6 questions you need to answer before issuing a benefits RFP.

Ever-expanding scope is a common challenge when managing an employee benefits RFP. Of course, we’d all like to be able to offer our employees every bell and whistle, unfortunately you must balance your benefits offering with your budget. An article from Employee Benefits Network puts it this way:

“When you’re looking for a straightforward recruitment solution, but a vendor shows you an AI tool for applicant tracking that is admittedly cool, it’s hard not to subconsciously add it to your list of requirements. It’s important not to let anyone shift the conversation away from your priorities. By sticking to your fully-defined scope, you can maintain objectivity as you score your vendors. Providing a justifiable recommendation based on established needs rather than the appeal of new functionality.”

So, before you put pen to paper creating an RFP, take time to understand your needs and goals. Then, create a business requirements document (BRD) that clearly outlines your scope.

If you need help creating a business requirements document, check out this helpful BRD template.

Now, as you enter discussions and begin assessing brokers and providers, verify that each offering they’re including maps directly back to a stated goal or requirement. Any add-on feature or benefit outside of your scope that adds cost shouldn’t be considered when you score the proposals and compare vendors. Not only does this help you stay focused, it can also encourage a provider to include those extras at no additional cost to win your business.

Key takeaway: Clearly define your employee benefits scope — and stick to it! As the employee benefits landscape adopts technology and evolves, there will always be something new and exciting to buy. But don’t let it distract you from your goals and overspend.

An RFP template is a great place to start, but it’s a terrible place to finish. Don’t get us wrong, at RFP360, we’re big fans of helpful RFP templates. Indeed, they can save a tremendous amount of time for procurement managers. However, they must be thoughtfully and thoroughly customized to truly be effective.

Whether you’re using an industry-standard template or recycling your last project, you always need to tailor your questions. Remember, if your RFP is thorough, clear and specific, you can expect the same from your broker proposals. Unfortunately, the reverse is true as well. If you use a generic RFP, you’ll likely receive generic answers.

So, take time to review your RFP template and tweak as needed. Review each question with your goals in mind. Then, remove questions that aren’t necessary for your decision-making process. Likewise, ask a combination of easy-to-score, closed-ended questions and open-ended questions that provoke insightful answers. And, provide as much background information as possible. For example, plan to include an overview of your current plan, challenges you’re facing and your goals for the project.

Key takeaway: Use a template, but make sure to customize it for your project. Generic, irrelevant or unclear RFP questions won’t get you any closer to making an informed selection.

Technology plays a big part in your employees satisfaction with their benefits. For instance, selecting a benefits broker or provider that offers an intuitive app or website that enables an employee to track their benefits, coverage or contributions improves their engagement and experience. Likewise, technology should be a part of your RFP process as well as your broker’s. Consider it a big red flag if a potential broker doesn’t leverage technology in their provider selection and evaluation process.

For instance, RFP management software is a benefit to any procurement team, but it’s particularly powerful for insurance brokers and consultants. Because it centralizes the entire process including request creation, vendor communication, response tracking, evaluation and scoring, sourcing software improves efficiency, consistency and transparency throughout the request management process.

Ask your broker what technology they use to serve their clients. Do they use RFP software to create, issue and score potential benefits providers efficiently? What technology will they use to communicate with you? How will employees access benefits and support services?

Once you’ve selected your broker, insist that the benefits RFPs they issue on your behalf include RFP questions that address each provider’s use of technology.

Key takeaway: Select a broker that embraces technology. Ask how their internal processes as well as their providers leverage solutions to better serve your business as well as your covered employees.

Before you send out your employee benefits RFP, ask yourself how you’ll be scoring the responses. Lockton, one of the largest employee benefits consultancies, is an expert in RFP efficiency. In a blog post about RFP best practices, they put it like this:

“When you send your RFP to multiple vendors, you need to have a way to compare their answers. Establishing your scoring method prior to sending out the RFP helps with how the questions are created and gives you a better understanding of what is important to you and why you are asking the questions you are asking. It is important when scoring responses to ensure that solutions meet core criteria (‘must haves’), which you should already have established prior to sending.”

We usually suggest using weighted scoring to ensure you evaluate your RFP for employee benefits based on the issues that are most important to you. For instance, most employee benefits broker RFPs focus on experience and provider relationships, ongoing service processes and pricing structure.

Key takeaway: Confirm your scoring method and your “must haves” before you hit send. This ensures your vendors know your priorities and your evaluation process will be as fast as possible.

Sample RFPs for employee benefits

Employee benefit RFP templates

- Employee benefits broker RFP template – PSF Inc.

- Benefits software RFP template – PlanSource

- RFP questions about employee benefits form (Word) – ISCEBS

Employee benefit RFP examples

- Benefits administration system example – State of Wisconsin

- RFP for employee benefits consultant example – City of Fort Collins

- Benefits consulting RFP example – Town of Chapel Hill

See how others issue better benefits RFPs

Ultimately, keeping your employees healthy, happy and productive is important to your business’s end goals. So, finding the right benefits provider is crucial. RFP software, like RFP360, can make the process much easier. Consequently, our customers include several employee benefits brokers and consultants who use the platform to better serve their clients.

“I think it helps put [clients] at ease and makes them a bit more comfortable. They can see what we’re doing — that it’s very objective and very clinical. They don’t have to worry about opinions being biased because they can see the scores, they can see the progress, and they have complete visibility into who was invited, who responded, and who didn’t.” – Kelly Ellis, Piper Jordan

Learn more about how Piper Jordan uses RFP360 in their case study.

“Using RFP360 allows us to focus on the most important aspects of the RFP and makes managing vendor information much more straightforward,” said Mark Rieder, NFP.

Explore NFP’s full use case and favorite RFP360 features here.

“We had templates in Excel, but we’d always have to add customizations. Then, we’d send multiple copies of those spreadsheets via email, and we’d have to track those emails individually. RFP360 helped us streamline our templates so we don’t have to add as much. We’re a billable-hour practice, so that reduction in time is great for clients. Additionally, we now have time to ensure our vendors understand the questions.” – Eric Hollenbach, Lockton

Read the full Lockton case study to see how they use RFP360 to save money for their clients.